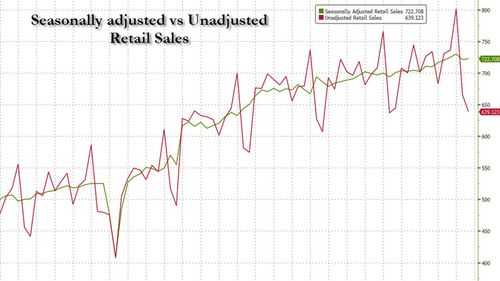

Retail Sales Drop More Than Expected in January, Plunging 0.9%

Retail sales slipped 0.9% for the month from an upwardly revised 0.7% gain in December, even worse than the Dow Jones estimate for a 0.2% decline. The sales totals are adjusted for seasonality but not inflation for a month, in which prices rose 0.5%. Excluding autos, prices fell 0.4%, also well off the consensus forecast for a 0.3% increase. A “control” measure that strips out several nonessential categories and figures directly into calculations for gross domestic product fell 0.8% after an upwardly revised increase of 0.8%. With consumer spending making up about two-thirds of all economic activity in the U.S., the sales numbers indicate a potential weakening in growth for the first quarter.

U.S. retail sales dropped sharply last month, in part because cold weather kept more Americans indoors, denting sales at car dealers and most other stores. Retail sales fell 0.9% in January from the previous month, the Commerce Department said, after two months of healthy gains. It was a much bigger drop than economists expected and the biggest decline in a year. The average temperature in January was the lowest since 1988, according to Pantheon Macroeconomics, and was particularly disruptive in the more temperate South. Devastating fires in Los Angeles may have also impacted spending.

Consumers kicked off 2025 with a more prudent approach to spending, with retail sales for January falling from a month prior. Yet while the report was a bad one, there’s no need to panic about the broader state of the consumer economy, economists said. The Census Bureau said Friday that retail sales slid 0.9% in January from December. Projections had them being largely unchanged, or down 0.05%, according to FactSet. Sales rose 4.2% on an annual basis.

News Results

US Dollar loses interest after weak Retail Sales figures

Retail sales slump. Wildfires, cold snap and post-holiday blues depress spending.

Retail sales post largest drop in nearly two years in January amid tariff uncertainty

Retail sales see biggest drop in a year to start 2025

US retail sales post biggest drop in nearly two years amid winter freeze

Economic News Has Started Catching Up To Sentiment

Retail Sales Fell in May But Core Sales Were Unexpectedly Strong

Retail Sales Face Key Tariff Test: How Could Markets React To Weaker Spending? - SPDR Select Sector Fund - Consumer Discretionary (ARCA:XLY), SPDR Select Sector Fund - Technology (ARCA:XLK)

Breitbart Business Digest: Consumers Say They’re Worried—But the Economy Isn’t Listening

Retail Sales Disappoint In February, Despite Major Downward Revisions

Tariff threats and uncertainty could weigh on consumers, drag down US economy, gov't report suggests