The Federal Reserve keeps interest rates unchanged

Despite signs of a slowing economy and with looming tariff worries, the central bank opted to stay put for now

LEFT

17m ago

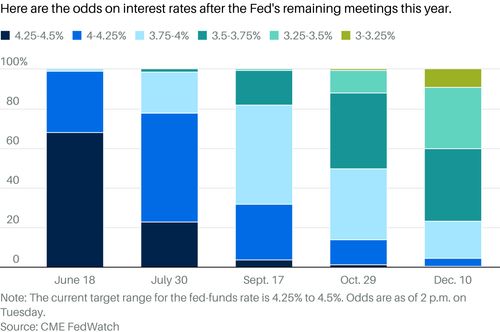

The Federal Reserve kept interest rates steady for the third consecutive meeting on Wednesday, as it cautioned about the economic fallout from tariffs. Why it matters: The Fed warned about the potential of higher prices and a spike in joblessness, as President Trump presses on with aggressive efforts to reset global trade. Driving the news: The Fed's rate-setting committee voted unanimously to keep the federal funds rate at a range of 4.25% to 4.5%. New language in the Fed's closely watched policy statement said the committee "judges that the risks of higher unemployment and higher inflation have risen."

The Federal Reserve’s interest rate setting committee held rates steady Wednesday at a range of 4.25 to 4.5 percent, despite calls from President Trump to lower borrowing costs amid price pressures from his trade war. Wednesday’s rate hold was the third in a row, following pauses during meetings in March and January after the central bank cut rates three times in the back half of 2024. The Fed’s move was in line with market expectations. One prediction algorithm based on future contract prices put the probability of a hold at about 98 percent just prior to Wednesday’s announcement.

The Federal Reserve on Wednesday announced that it will leave its benchmark interest rate unchanged as policymakers continue to monitor inflation and the labor market amid elevated levels of economic uncertainty. The central bank's decision leaves the benchmark federal funds rate at a range of 4.25% to 4.5%. It comes after the Fed left rates at that level at its two previous meetings in January and March, which followed three consecutive rate cuts at its preceding meetings – which involved a 50-basis-point cut in September and a pair of 25-basis-point reductions in November and December.