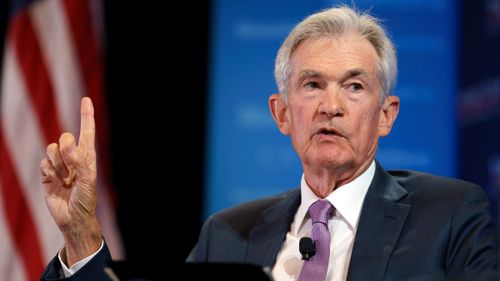

Live Updates: Federal Reserve Meets as Investors Focus on Rate Cuts to Come

The Federal Reserve maintained its benchmark interest rate on Wednesday, keeping borrowing costs at their highest level in more than two decades despite a prolonged cooldown of inflation. An interest rate cut is widely expected in the coming months. The Fed issued its latest interest rate decision after a months-long stretch of data has established the key conditions for a rate cut: falling inflation and slowing job gains.

See you in September. That pretty much sums up the sentiment of the Federal Reserve, which once again voted to hold interest rates steady, as most experts expected. But the Federal Open Market Committee’s statement following today’s meeting will likely raise hopes of a rate cut in September.

The stock market’s rally mostly held steady after the Federal Reserve’s policy committee kept interest rates steady at its July meeting. The Federal Open Market Committee said Wednesday it maintained the target range for the federal-funds rate at 5.25% to 5.50%, which was widely expected by traders. The Dow Jones Industrial Average was up 230 points, or 0.6%. The S&P 500 was up 1.5%. The Nasdaq Composite was up 2.3%. All three indexes were rallying in the hours leading up to the decision.