Fox News

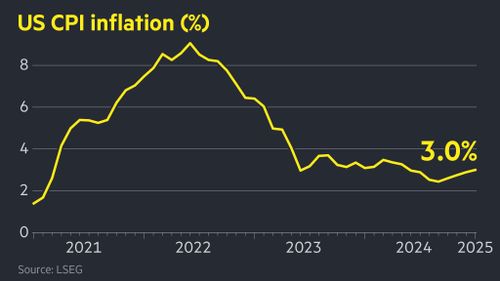

Fox NewsInflation came in hotter than expected in January

CPI increased 3% in January from a year ago, higher than the 2.9% forecast. The new data means inflation has heated up for four straight months. Fed chair Jerome Powell said Tuesday that the economy is strong and the US isn't in a recession.

LEFT

38m ago